NAV Information Commentary

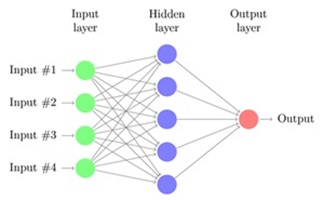

If you have been recently looking at the Market Risk Indicator you may notice that the primary graph has changed. After months of testing and adjustment this new methodology appears to be ready for...

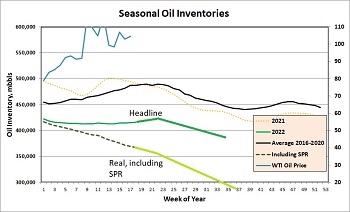

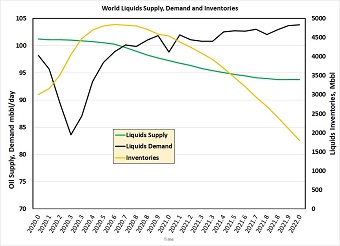

As was previously posted(When will it end) the Oil Supply vs Demand situation has been, and is bullish for the price of oil. Let’s do a more detailed dive into the numbers to see...

In my last post the topic was When will it(the Oil Downturn) End? Now it is time to revisit the production charts and forecasts to see where we are in the healing of the...

This has been an unprecedented time in the stock markets, and in the world. Covid -19 has ravaged the world economy and as of writing this post, still dominating the headlines and impacting our...

What an incredible time in the World stock markets, volatility(to the downside), pandemics, credit market collapse and an oil market collapse. First and foremost I hope that my readers are healthy and safe, in...

Now that 99% of companies have reported their yearend 2018 reserves and Company value it is time to drill down into the database and analyze the results. These highlights will help guide our stock...

The recent drop in the energy stocks on the Toronto Stock Exchange(and other exchanges) is extreme and it is time to dig into the numbers and some of the causes of this recent stock...

Last year’s reserve reports are finished, and it is a good time to look at last year’s financial numbers to see the star companies and the ones that are more “challenged”. This is also an...

As one of the top performing Energy Stocks on the TSX this last year one should stop and look in depth at the numbers to ask the question, why Yangarra Resources. This energy stock...

The recent stock price drop in Seven Generations reminds us that valuation matters and even the most popular stocks can have a reassessment by the market as to what they perceive the value of...