Suncor, Raging River, and Gear Energy

The investment bankers have been busy crafting deals and selling equity into the market. In the last couple of weeks Suncor, Raging River, and Gear Energy have done deals or issued shares and I thought it might be time to comment on these events. In summary

- Suncor issued $2.5 Billion of new shares to pay for the Canadian Oil sands acquisition, Murphy Oil acquisition and pay down debt. This should increase the NAV of Suncor by issuing shares that are overvalued and using the proceeds for the acquisitions and debt retirement .

- Raging River made an offer to purchase the outstanding shares of Rock Energy, a heavy oil producer. At first glance this is a puzzling acquisition but there is the possibility of 25 sections of land in the prospective Viking reservoir that could be added to the drilling inventory.

- Gear Energy made a merger proposal for Striker Energy(takeover). The interesting part of this deal is that both companies are undervalued and neglected by the market.

Suncor Issues $2.5 Billion of Equity

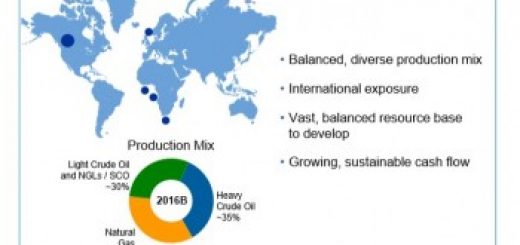

This share issue is not surprising and badly needed to repair Suncor’s stretched balance sheet and pay off some of the debt that was assumed during the recent acquisition of Canadian Oil Sands and Murphy Oil’s ownership in Syncrude. With these two deals Suncor now controls the largest working interest in the Syncrude Oil sands joint venture. Although Exxon(Imperial Oil) is remaining as operator, this now gives Suncor the leverage to improve the operations of this property and possibly assume operatorship in the future.

The deal involved issuing 75 million shares at $35.00/share for the gross proceeds of $2.5 billion. Of course the investment bankers that brokered the deal take their commission and are probably quite happy today. Great for the I-Bankers, but what about the poor shareholders, how have they done with this dilutive share issue. Recently on this website I went through the financials of Suncor and detailed how it was a great company, but an overvalued stock. This share issue, with overvalued shares, is a great idea to increase the NAV. By the same calculation methodology the 2P NAV moves from $25.20/share to $25.60/share. Hardly moves the needle but the right idea with the paper you have. In their press release they allude to further acquisitions with the proceeds, and to that I say happy hunting!

Raging River Acquires Rock Energy

This one is a bit puzzling since my perception about Rock was more of a heavy oil producer and this seemed a bit off strategy for Raging River. The management skills for a light oil driller in the Viking may not be a good fit for heavy oil and may confuse investors about corporate direction and strategy. Reading the press release though, there are 450 bbls/day of Viking oil production and Raging River alludes talks to 25 net sections of prospective Viking acreage. I would expect that after the deal is closed that the assets that are not on strategy and have no further upside will be sold back into the market to help fund the deal. What about the price paid?

Raging River trades at a high premium of $10.25/share to their 2P(Proved plus Probable) NAV of $5.1/share. They will issue 3.9 million of these overvalued share to do the acquisition which is good, using their paper to add value. What about the other side of the deal? Rock’s latest Corporate reserves value the company(2P) at $197 million. Take off $67 million for net debt and the asset is worth $130 million. Paying $40 million for $130 million sounds good to me, especially when your paper is only worth $19 million! Good job Rock and the management team. This helps fill out your depleting drilling inventory(some say it would be drilled up in 4 years, now a bit longer). Rock shareholder are probably a bit disappointed on the small premium as you can see by the attached chart, my condolences. A 10% premium that disappears in the days after the deal is announced is nothing to write home about.

Gear Energy Merges with Striker Energy

This deal has the appearances of trying to put two unloved, un-noticed companies together to try and get some more market respect. Both companies are undervalued oil companies that show up in the Data Tables as undervalued companies. Gear with 160% upside and Striker with 140% upside both look attractive to me. Gear with a 2.8 x debt/cash flow is more levered than Striker with 0.8 debt/cash flow so this may help the combined company with Strikers balance sheet. Both companies are shrinking fast(over 30% year over year decline in production) due to the lack of drilling, so maybe this will allow them to raise capital and stop the decline in production. Stay tuned since the oil markets will recover and this “new’ company may be able to bootstrap themselves out of the doldrums with this deal. Just to show how little respect this deal gets in the market, two stock charts showing a lot of market indifference.